Travel Insurance Price Factors: How We Get Your Quote

One of the most commonly Googled travel insurance questions is “how much does travel insurance cost?” And a natural follow up to that question is “why is it that price?” We’ll answer that question by outlining some of the factors that affect the price when you get a quote for Generali travel insurance, and just as important -- what doesn’t affect the price.

The price for travel protection varies depending on your trip details, but the average is somewhere between 4-12% of your total trip cost. Next, we’ll find out why there is such a wide price range based on the coverage you choose and details of the trip you are taking.

How We Calculate the Price for Travel Insurance with Assistance Services

When you enter your information into our quote form, have you wondered what happens behind the scenes to get you the right price for travel insurance?

It’s simple to get a quote to insure your trip. You only need to answer a handful of questions and an instant later we give you custom prices for your trip and the choice between three plans with different levels of protection. You can get the quote in an instant, but in the background we’re crunching numbers to make sure you get an accurate price for the coverage you need.

We’ve found the sweet spot to ask you the right questions to offer you the best price we can, while making the quote form easy to fill out. Consider this when shopping around: If a company is asking you too few questions, they may not be able to find the most accurate price for your travel situation.

There are several factors that affect the price of a travel insurance quote for the plans on this website. These include:

Trip Cost

Try our Trip Cost Calculator to help get an accurate travel insurance quote

One of the biggest factors affecting travel insurance price is the “total trip cost” entered when getting a quote. This is the amount that you can be reimbursed for if you submit a claim for Trip Cancellation or Trip Interruption due to a covered event and the plan requirements are met.

When getting a quote, you should enter your non-refundable, pre-paid trip costs that are associated with your insured trip that you wouldn't recoup if you cancel your trip and paid before you leave on your trip. Take into account flights, cruises, accommodations, tours, entertainment and other trip costs that could be lost if you're prevented from taking your trip.

In order to qualify for coverage for pre-existing medical conditions or the Trip Cancellation for Any Reason (CFAR) add-on coverage (only available with the Premium plan), one of the requirements is that all prepaid trip costs that are subject to cancellation penalties or restrictions must be insured.

Also read: 4 Reasons Why Travel Insurance Is a Must for Expensive Trips

Number of Travelers

Another important factor is how many people will be insured under the travel insurance plan. The more people, the more chance that an expensive, trip-wrecking event might occur. It’s that simple. You can insure up to 10 people on the same plan.

Trip Duration

The length of time you’re on the trip can affect the plan price as well. The reason behind this factor is similar to the number of travelers – the more days you’re away from home, the more the odds go up that you will need to file a claim.

Time to Departure

The price of your plan also depends on how far from your departure date it is when you buy the travel insurance. The more time between buying insurance and leaving on your trip, the more it can cost to insure the trip. The longer the time to departure, the greater odds that you will need to cancel your trip and be reimbursed.

Also read: Timing When to Buy Travel Insurance

Selections you make after the initial quote will also affect the price:

The Plan You Choose

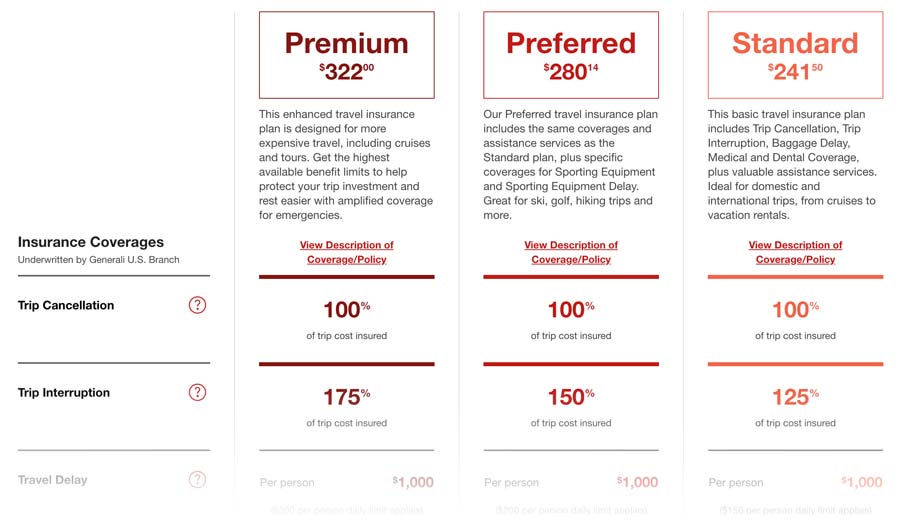

We offer three travel insurance plans: Standard, Preferred and Premium. Each plan has a different level of coverage and available features, such as coverage for pre-existing medical conditions and CFAR.

This is a factor you control that can have the largest effect on the price of your plan. Remember that the cheapest plan may not be the best plan for you. It’s important to weigh the price and the coverages you might need when deciding.

Learn more about our three plans

Add-on Coverages

We offer Rental Car Damage and CFAR as optional add-on coverages that are an additional cost on top of your initial travel insurance quote price. Choosing one of these options will increase the cost of your plan. Rental Car Damage coverage is included with our Premium plan.

Those are the main factors that we use to determine our travel insurance price, but since insurance is a complicated business, there may be other variables at play as well.

Also read: What You Need to Know Before Getting a Travel Insurance Quote

What Doesn’t Affect Travel Insurance Pricing

Now that you have a better idea of how we come up with your travel insurance price, let’s go over factors that are not considered in that calculation.

- Claims History: If you’ve used Generali travel insurance in the past, or any travel insurance for that matter, claims you have submitted in the past are not considered when we determine your quote price. This might be different from your experience with other insurance, such as auto insurance. But don’t worry – your previous claims do not affect our prices.

- Medical History: We ask no questions about your medical history when you get a quote and it is not a factor we use to calculate your price. Pre-existing medical conditions might affect your coverage, but not the price of your plan.

- Travel Suppliers: Our prices are not affected by which travel suppliers (airlines, hotels, tour operators, etc.) you are using for your trip. When you pay for your plan, we ask what travel suppliers you are using, but this does not affect the coverage or price of your plan.

- How You Buy: There is no need for you to shop around to get the best price for the plans on this website. You will not find a price difference based on how you purchase a plan. Whether you buy on our website, on the phone or even on another website that sells our plans, given the same quote factors, you will be offered the same price for each plan. As part of a regulated industry, the law requires prices to be consistent and no discounts can be offered.

Compared to the hoops you need to jump through to purchase some insurance, like life or auto coverage, getting travel insurance is a simple process. No need for a health check or other screening, just a handful of questions and you’re on your way with some peace of mind for your trip.

It’s always nice to know what factors go into the prices we pay – and especially with insurance, it’s a good idea to know the details. Now that you know how we determine the price of travel protection, the next step is to get a quote and see the process in action.

Travel Resources

See AllB000062206