COVID-19

If you, a family member or a traveling companion are diagnosed with COVID-19 before or during your trip, and meet the requirements for coverage due to sickness, you can be covered for Trip Cancellation, Trip Interruption, Travel Delay, Medical & Dental, and Emergency Assistance & Transportation, in addition to our 24/7 Emergency Assistance services.

Trip Cancelled

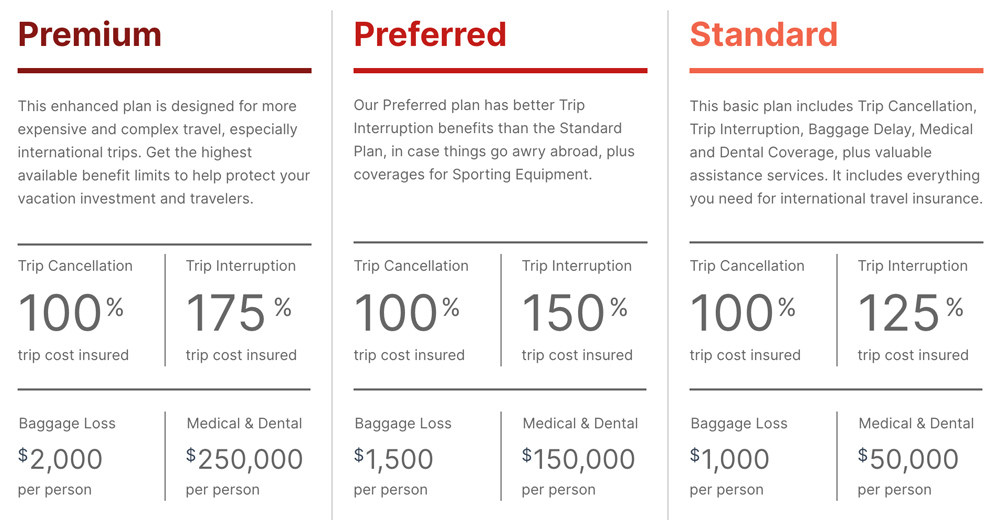

If you’re forced to cancel your trip, how much of that prepaid trip cost could you get back? Travel insurance can help you recoup losses for around 20 different types of events that could cause you to cancel your travel plans.

Trip Interrupted

If your trip is interrupted due to something like a canceled flight or medical emergency, it could cause a ripple effect across the rest of your trip, and travel abroad can get pretty complex. In that case, trip insurance can help you get reimbursed for unused, non-refundable, pre-paid trip costs that weren't used and additional transportation costs to return home or rejoin your group.

Lost, Damaged or Delayed Baggage

When you're traveling, problems with baggage can really be a pain. With one of our plans you could be covered if your bag is lost, damaged or stolen, and we can help ease the pain by reimbursing you for the purchase of necessary items when your baggage is delayed for a specified amount of time.

Medical Emergency

Our international travel insurance plans can help you with a wide range of medical needs while you’re traveling. Whether it’s a case of simply needing to see a local doctor for prescription refill, a visit to the emergency room, or the rare need for medical evacuation by air ambulance, we’re there for you 24/7/365.

Learn more about travel insurance for your international trip